No products in the cart.

Articles

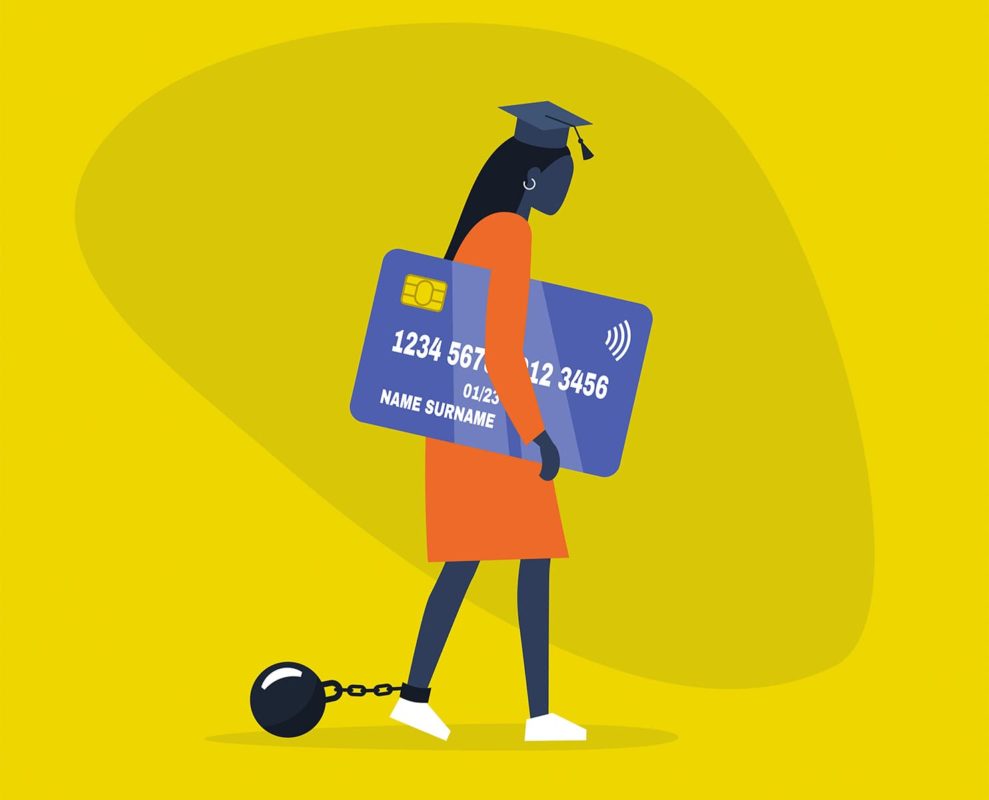

Unpaid Student Debt Could Give you Heart Trouble

May 5, 2022 — The stress and nervousness of dwelling with substantial scholar debt is nothing new. As many as 43 million Americans face the twin challenges of making an attempt to prosper and repay federal school loans on the similar time.

A brand new research may add one other fear: For the primary time, researchers have linked unpaid scholar debt to a better threat for heart problems in midlife.

Reactions from folks with scholar debt amounted to “great, another thing to worry about.”

“What else can we pile on the shoulders of debtors?” requested Karen Lee, a Massachusetts girl who moderates the ForgiveStudentMortgageDebt.com group on Facebook.

Case in level could be Pam Putnam-Colasanti, a 63-year-old girl who acquired her grasp’s diploma in 2009 from Brightwood College in Fort Lauderdale. She commented within the Facebook group that she has heart problems and “crippling debt for the final 18 years.”

The massive image right here isn’t a lot brighter.

“Our findings reveal some hidden prices — well being prices, on this case — of failing to behave on the nation’s scholar mortgage debt disaster,” says researcher Adam Lippert, PhD, from the University of Colorado.

Moving folks towards a way forward for cardiovascular sickness “is hardly sound fiscal coverage,” Lippert says.

Modifiable Risk

On the plus facet, scholar debt is a probably modifiable threat issue. If federal officers act to alleviate the burden related to scholar debt, many might even see improved well being and at the least the delay of the onset of continual circumstances, Lippert says.

President Joe Biden is reportedly getting near coming by on his promise to ease the burden of scholar debt for a lot of Americans. His proposals vary from slicing at the least $10,000 to quantities lower than $50,000 from scholar mortgage debt, probably linked to earnings ranges.

Some analysis has already proven different varieties of debt could result in coronary heart hassle, together with one research that regarded on the connection between bank card debt and poor well being. The present research was revealed on-line May 3 within the American Journal of Preventive Medicine.

Stress is tied to larger ranges of irritation. Chronic irritation was larger for folks within the research with ongoing school debt in comparison with others who managed to repay their debt or who by no means took out scholar loans.

People with debt additionally face larger dangers of different coronary heart failure.

More Than Half Carry Debt

More than one-third of the practically 4,200 research individuals had no scholar debt. Twelve p.c paid off their loans, 28% took on scholar debt, and 24% constantly remained in debt.

Cardiovascular threat scores had been larger for individuals who constantly had been in debt or took on new debt in comparison with these by no means in debt.

Those who had scholar loans and paid them off had decrease cardiovascular dangers than those that had been by no means in debt.

Future Implications

Another implication of the research is that scholar debt reduces the well being and financial advantages many individuals with 4-year school levels expertise usually.

Student debt reported on the family stage is a possible limitation of the analysis as a result of member of the family debt may have contributed to outcomes. However, the researchers repeated the analysis in folks with out grownup youngsters and outcomes had been comparable.

Another limitation was measuring threat at a single time level. Future research ought to take a look at a number of measures of cardiovascular threat and irritation ranges over time, the researchers recommend.